In Virginia, homeowners have three incentives which makes converting to solar much cheaper than staying with your current utility:

- Net Metering

- Federal Tax Credit

- Solar Renewable Energy Certificates (Carbon Credits)

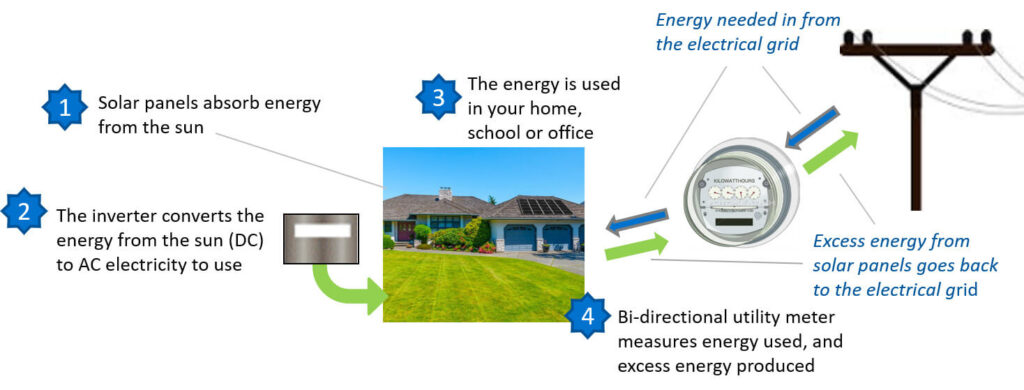

Net Metering

When your solar system produces more electricity than your house needs, this excess electricity is sent back to the power grid and creates a credit with your utility. Think of it as an energy bank account. When your panels are not producing (such as at night), your utility provides you with your banked credits so there is no cost to you (a withdrawal from your energy bank account). If your house needs electricity but you have no credits remaining, your utility will sell you electricity at your current retail rate.

Most utilities in Virginia (such as Dominion Energy) have a Net Metering ratio of 1 to 1. Meaning, you receive 100% credit for all the excess electricity that your provide. Once a year, your utility will do a “True up” where they either pay you for your current credit balance (at your current retail rate) or allow you to roll over the credits into your next solar year. Net metering allows us to size your solar system so that you produce a year’s worth of electricity in the 200 or so sunny days Virginia experiences each year. So even on cloudy days, your home is still a solar home because you are using the credits you banked during the sunny days!

Federal Tax Credit

The Federal government gives homeowners a 26% tax credit (based on the total cost of your solar system) for the year in which your system is activated. This tax credit is applied against the tax liability you have for the year. If your tax liability (AKA your withholding) is greater than your tax credit, you get a nice check. If you do not have enough tax liability to cover the tax credit, you have up to 5 years to recover your entire credit.

Example: Your solar system costs $20,000. Your Federal tax credit at 26% is $5,200. You make $100,000 per year and your tax liability (withholding) is $10,000. You will receive a check for $5,200 when you file your taxes.

Click on the image below for more information

Solar Renewable Energy Credits (Carbon Credits)

You get paid a monthly “rebate” for going solar.

In 2020, Virginia passed a law called the Clean Economy Act. This law requires Virginia utilities to be carbon neutral by 2050 by closing all their fossil fuel plants and replacing that energy generation with renewable sources such as solar farms and wind turbines. The law sets annual benchmarks for the percentage of renewable energy in the utility’s portfolio. When the utility falls short of the benchmark, they have to pay a penalty of $75 for every megawatt (1,000 kilowatts hours) they are short. OR, they can purchase carbon credits from a third party – like you.

When you convert to solar, you receive a carbon credit for every megawatt (1,000 kilowatt hours) of electricity your system generates. We register you with a broker who can sell the credits on your behalf. Currently (May 2022) each credit is selling for between $60 and $70.

The average solar system size is 9 KW which produces between 11,000 and 12,000 kilowatt hours a year. Therefore, the average system will produce 11.5 carbon credits a year at an average of $65 each. This is about $750 each year (or $60 each month) you will earn by going solar. When you factor in this monthly “refund” to the new solar payment, some homeowners lower their monthly electric costs by more than half!